“The task in 2023 is to increase the volume of P0.9 and break through to P0.6 extreme small spacing!” The leader of a large domestic small-pitch LED display manufacturer discussed the development plan for the “2023” year.

In the eyes of industry insiders, a new round of mini-led technology maturity and the rise of applications is inevitable. In the future, who will become the dominant player in this segmented display field will again focus on “who can take the lead in developing new markets”. In this regard, the industry expects that the price war of P0.9 products, the new scenario of P0.6 products, the new form of war, and a new wave of “mergers and acquisitions”, the expansion wave has begun to brew.

Breaking through the boundaries of traditional markets, mini-led is in action

The leader in LED packaging, Nationstar Optoelectronics, will launch the standard version of IMD 0.9 at the end of November 2020, gradually breaking the price bottleneck and is expected to reach 0.015 yuan/pixel in 2021. The existing IMD production capacity of the RGB Super Division of Nationstar Optoelectronics is 1000KK/month, and it is planned to reach 2000KK/month in Q1 of 2023. As one of the main suppliers of P0.9 products, the plan to double production capacity is good news for the industry.

On the other hand, from the perspective of terminal cost, most of the P0.9 products using the independent mass integration process will turn to the COB flip-chip process – compared with the full-scale products, the welding cost of “gold wire” will be saved on a large scale .

Therefore, the cost difference between the P0.9 level products and the previous 1010 lamp bead products will be mainly determined by the PCB board and the LED crystal. According to reports, the company represented by Nationstar Optoelectronics directly selects the wavelength and brightness range of the wide color gamut from the chips purchased by the 1010 device for the p 0.9 device, and its test and sorting efficiency has been improved by 25% – or, With upstream LED crystal manufacturers, the process technology progresses on mini-led sized grains, the cost of “LED crystal” decreases, that is, from the selection to the universal election, there is still a large room for improvement.

In terms of PCB board, it is obvious that the pixel pitch index becomes smaller, and there are higher requirements for the fineness and flatness of the PCB board circuit. This is part of the cost pressure. However, the cost pressure of PCB boards is more concentrated on the “previously limited demand scale”, which belongs to a small number of customized products. That is, the scarcity of the supply side has become the main cost pressure.

To sum up, the industry believes that P0.9 products are in the channel of rapid cost improvement, and there is indeed room for cost reduction. Even in the future, it cannot be ruled out that the IMD 0.9 product of Nationstar Optoelectronics is cheaper than the 1010 product.

Therefore, the industry believes that it is possible for the P0.9 spacing to eventually unify the current P1.0 to P1.2 product market – considering that the current P1.2 product is the “profit cow” of small-pitch LEDs, which determines the entire industry The industrial chain has huge desire and inevitability to promote the popularization of P0.9 products.

On the other hand, after the new wave of P0.9 products in 2019, from the end of 2020 to the beginning of 2021, P0.6 products have ushered in a new wave of products: for example, in February, Absen launched a 220-inch 8K screen (P0.6 ), 4K screen 110 inches (P0.6) 2K screen 55 inches (P0.6) three standardized LED display products.

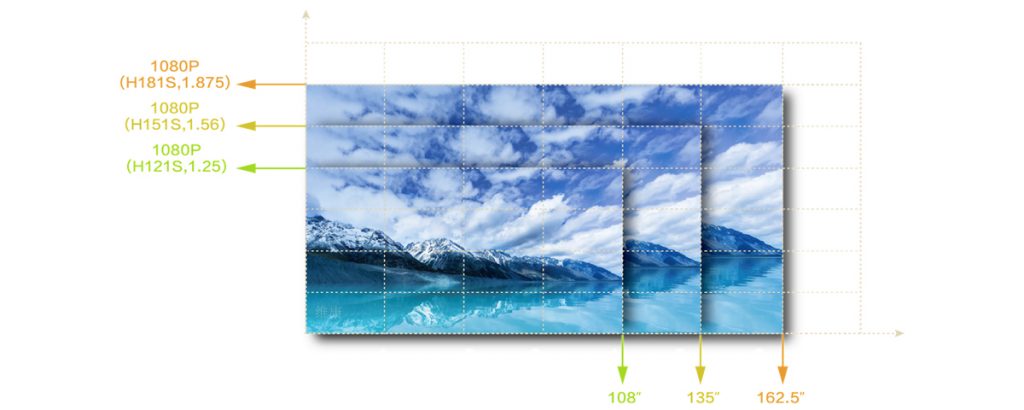

If it is said that P0.9 products are more of a technological improvement for high-end applications in the traditional LED large screen market, then P0.6 products have been defined as the pioneers of ‘new scenarios in the future’.” For example, industry experts pointed out that in 100 -200 inches, providing high-quality 8K display screen, P0.6 small-pitch LED screen, is currently the core and most feasible technical route. This will occupy a market advantage in the era of 8K ultra-high-definition film and television.

Among them, this product is attractive for high-end conferences, entertainment, or home use. These new application scenarios may include 8K live broadcast applications for the Tokyo Olympics or the Beijing Winter Olympics – for example, using high-quality 220-inch 8K live broadcast screens in themed sports bars.

In fact, the display fineness of P0.6 products has reached the level of LCD flat-panel TVs 10 years ago. This is a very high performance breakthrough. This allows the large LED screen to enter the traditional liquid crystal display application market and scene, and provide a larger screen display performance; it can also fully replace the projection display equipment required for display in a strong light environment, and then become another major category. New players in the market.

After P0.9 enters the popularization stage, promote the upgrade of the new P0.6 standard”, which has become an industry consensus and is a powerful weapon for corresponding companies to seize the commanding heights of technological innovation and expand the market in new scenarios. “another potential flashpoint.

LED companies are deploying new directions, and the battle for the market has begun

The success or failure of the market below 1.0 spacing will be a brand elimination battle. “People in the LED industry believe that with the improvement of technical precision, the market threshold and product threshold have become higher. Not all companies can complete the important task of “a new round of product upgrades” and market landing. This determines that a new round of products competition has “a qualitative meaning beyond quantity”.

From the technical route, the IMD technology of Nationstar Optoelectronics is particularly friendly to more small and medium-sized LED screen enterprises. This technology is equal to the difficulty of National Star Optoelectronics transferring a huge amount of technology, most of which are “digested by themselves”. Therefore, with the increase in the supply scale of the IMDP0.9 mass production version, more brands can be expected to provide products with corresponding technical levels. Similar Nationstar Optoelectronics also provides IMD technology products of P0.5 and above, helping more companies enter the era of LED display below 1.0.

Another technical route is that many companies have adopted self-developed “mass transfer” process technology to enter the era of spacing below P1.0. This requires manufacturers to have stronger R&D capabilities and market expansion capabilities, which are more suitable for industry leading brands. By mastering the mass transfer process, brands can improve the technical differentiation of products and the length of their own industrial chains, laying the foundation for higher profitability in the future. The disadvantage of self-developed mass transfer technology is that the initial investment is relatively large. When the certainty of the market size is not good, the corresponding product line system may suffer long-term losses.

In addition to the “differences” and “new layouts” of corporate strategies on the technical route, LED screen companies are also “innovating new ones” in terms of market strategies. For products below P1.0, the largest market must come from “new scenarios”. This is the industry consensus: to achieve the horizontal expansion of the target market scene is an inevitable proposition in the era of small-pitch LED display below P1.0.

On the one hand, products below P1.0, especially products such as P0.6, are already in the same market competition category as liquid crystal displays. How to coordinate the competition and cooperation between the LED screen and the LCD screen involves the completeness of the product line. In this regard, Leyard, Unilumin, JYLED, etc. directly deploy LCD commercial display products, forming the most complete commercial display product solution size line starting from tens of inches, and building a larger market expansion for LED products in the ultra-dense pitch era. Synergy.

On the other hand, as in the five-year period from 2012 to 2017, with the rise of the LED screen market with pitch indicators below P2.0, many brands have adopted means such as “mergers and acquisitions” as a starting point for rapid breakthroughs in new application scenarios. Although this has left a lot of goodwill “lightning”, it is still very positive for greatly accelerating the progress of the industry market. The industry believes that in the P1.0 era, some manufacturers of small-pitch LED companies still have the practical value of “merger and integration”.

Even, considering that P1.0 products have further penetrated into the “site” of traditional display technologies such as LCD and projection, the latter will not sit still: How do LCD and projector commercial display brands enter the product market below P1.0 spacing? The merger and integration of pitch LED companies is possible, and it is also a “scenario” that can be imagined.

The breakthrough significance of the P1.0 era is likely to be more significant than the popularization of P2.0 10 years ago! “This is not only because the ultra-clear and ultra-high-pitch display is originally the biggest fundamental of the display industry, but also because the smart society brought by 5G+AI will inevitably expand the potential scale of the commercial display market: technological progress and market demand expansion The benign resonance of P1.0 can be expected, and 2021 will become the first year of the popularization of the P1.0 era.

Under such an expected judgment, the industry believes that 2023 will be a critical moment for the small-pitch LED market, price competition, competition in new application scenarios, new products emerging in an endless stream, market mergers and acquisitions, and a variety of companies heading for expansion!